![]()

In recent years, cryptocurrency has revolutionized the way we think about money and finance. With the emergence of Initial Coin Offerings (ICOs), a new kind of fundraising model has been created that is aimed at helping startups and other projects raise capital quickly. ICOs are an important part of our global economy, as they offer investors access to early-stage investments that can bring substantial rewards.

The world of cryptocurrency has been rapidly evolving since its inception in 2009. With the introduction of Initial Coin Offerings (ICOs), cryptocurrency has opened up a whole new realm of potential investments and opportunities for companies, financial institutions, and individuals alike. ICOs are digital tokens that serve as investments and are released by start-ups to raise capital for their projects. By understanding how ICOs operate, investors can gain insights into the digital currency markets and make informed decisions about which cryptocurrencies to invest in.

What is an ICO?

An ICO, or Initial Coin Offering, is a fundraising method used by blockchain startups to raise capital for the development of their projects. Similar to Initial Public Offerings (IPOs) in the traditional stock market, an ICO allows companies to sell tokens that can be exchanged for cryptocurrency as a form of crowdfunding. The tokens are typically issued on Ethereum’s blockchain network and represent a stake in the company or project.

Alternatively, they may grant holders certain rights such as voting power within the platform or access to certain features that regular users cannot access. Companies must provide detailed information about their projects such as its purpose and roadmap before launching an ICO so that potential investors can make informed decisions while choosing where to invest their money. After successfully raising funds through an ICO, the company will use them to further develop its project and work towards reaching milestones set out in the roadmap provided before launch. This makes investing in an ICO somewhat of a gamble since there is no guarantee that it will eventually succeed even after being funded.

Benefits of Investing in ICOs

One of the major benefits of investing in Initial Coin Offerings (ICOs) is that they offer a relatively low barrier to entry. ICOs have no geographical restrictions, meaning anyone in any part of the world can participate, regardless of their location. This makes them a great option for investors who would not normally be able to access traditional investments such as stocks and bonds. ICOs also offer the potential for high returns on investment, which can make them an attractive opportunity for investors looking to maximize their profits.

Additionally, some ICOs are structured in such a way that there is little risk involved when investing; many projects will offer tokens that guarantee ownership rights or voting rights within the company itself. This gives investors additional assurance that their funds are being used legitimately and safely within the project. Furthermore, ICOs often provide bonuses depending on how early you invest; this encourages more people to get involved and can help boost overall investor confidence in a given project.

Finally, participating in an ICO provides more transparency than other forms of crowdfunding: each transaction is recorded on a transparent blockchain ledger and all token holders receive regular updates about how their funds are being used within the project. This helps ensure accountability from both parties (the developer and investor) and increases security for everyone involved with an investment project via an ICO.

Risks of Investing in Initial Coin Offerings

One of the biggest risks associated with investing in ICOs is the lack of regulation. As ICOs are relatively new, they fall outside established securities regulations and laws, meaning that investors have no assurance that their money is protected. Furthermore, there is no guarantee that the new currency will be accepted or successful on any cryptocurrency exchange platform.

Another risk is the possibility of fraud. Since ICOs often raise large sums of money quickly, they can attract scammers who look to take advantage of inexperienced investors. It’s important for potential investors to conduct extensive research into each project before making a decision as not all projects are legitimate or reliable investments. Additionally, some projects may fail to deliver on their promises and fail due to mismanagement or a lack of resources.

Finally, there are technological risks associated with investing in ICOs such as technical failures or security breaches. If a project fails due to an unforeseen technology issue, then investors may lose their funds if it cannot be recovered from any backups or other sources available at the time. Additionally, hackers could target an exchange platform storing tokens from an ICO and steal those assets which would cause losses for investors holding those tokens on that platform.

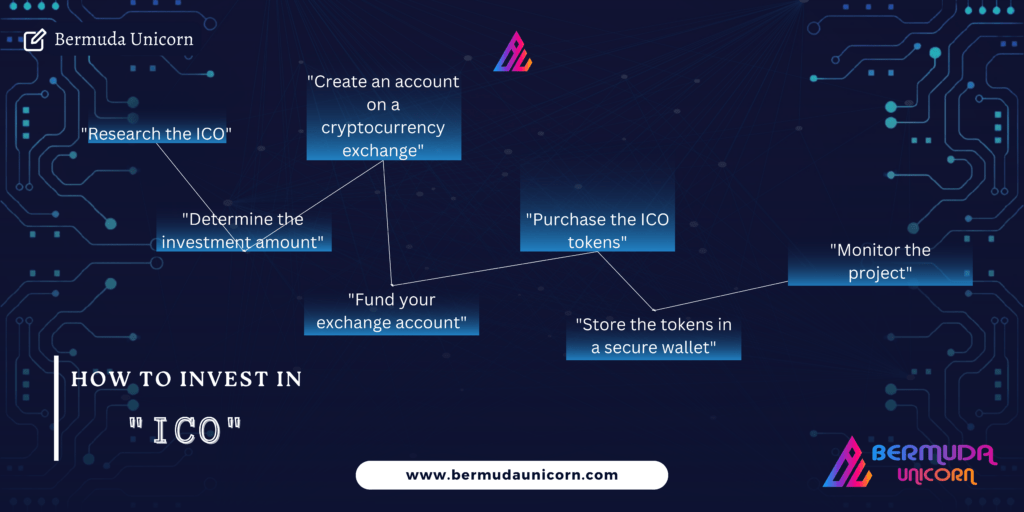

How to Invest in ICOs

Once you have decided to invest in an ICO, it is important to understand the process of investing. You must first research the project and its development team, token economics, and potential profitability. It is also important to consider where you are going to store your tokens once they are released – some platforms may not be compatible with certain tokens.

After researching your chosen ICO thoroughly, you will need to purchase cryptocurrencies such as Bitcoin or Ethereum that can be used for payment. Once purchased, these cryptocurrencies must be transferred into a wallet owned by an exchange platform that allows the trading of tokens associated with the ICO. This should give you access to buy into the Initial Coin Offering when it launches. When considering a purchase, remember that there is inherent risk involved with investing in any form of cryptocurrency, and take precautions before investing large amounts of money.

Regulation of Initial Coin Offerings

The raised funds through ICOs are generally not regulated, which means that the investors do not have protection against fraud or theft. As such, there is a growing concern about the lack of regulation and oversight in this area. However, some countries have begun to regulate ICOs more closely in order to protect investors from financial losses due to fraudulent activities.

One of the most common regulatory approaches is known as a “know your customer” (KYC) policy. This requires companies issuing an ICO to verify the identity of their customers before they invest funds into their projects. Additionally, many countries require companies conducting an ICO to provide detailed information about their project including a white paper outlining its goals and objectives, as well as disclosing any risks associated with it. Furthermore, many countries also require companies conducting an ICO to register with their financial regulators so that they can be monitored for compliance with regulations and investor protection laws.

Finally, some countries are beginning to require cryptocurrency exchanges—the platforms on which tokens issued by an ICO can be traded—to register with local authorities and comply with anti-money laundering (AML) regulations in order to protect investors from fraudulent activities. Regulatory bodies around the world are continuing to work towards identifying more ways of protecting investors while still allowing innovation in the space by providing clarity around what is permissible when it comes to launching new projects via Initial Coin Offerings (ICOs).

Conclusion: Future of Cryptocurrency

The future of cryptocurrency is still largely up for debate. Despite the recent surge in popularity, many experts are skeptical about its long-term prospects. Some believe that cryptocurrencies could eventually become mainstream, replacing traditional money and becoming widely accepted by retailers and financial institutions alike. Others argue that this will never happen due to the lack of regulation and the inherent instability of digital coins.

Nevertheless, there is no denying the potential for cryptocurrency to revolutionize our financial system. Initial Coin Offerings (ICOs) provide a way for new companies to fundraise without having to go through established channels such as banks or venture capital firms. This opens up a world of possibilities; blockchain-based startups have already begun developing projects in various industries including finance, healthcare, logistics, energy and more. With an ever-expanding range of use cases and evolving regulations, it seems clear that cryptocurrency has a promising future ahead of it – one where its potential is unlocked on a global scale.