![]()

Cryptocurrencies have taken the financial world by storm, reshaping the way we think about money, assets, and investments. Within the realm of digital assets, two terms have gained significant prominence: “fungible” and “non-fungible” tokens. Also, these concepts play a crucial role in the evolving landscape of blockchain technology and have far-reaching implications for various industries. In this blog, we will explore the differences between fungible and non-fungible tokens, their applications, and their significance in the world of crypto.

Fungible Tokens: The Interchangeable Assets

Fungible tokens represent a class of digital assets that are interchangeable on a one-to-one basis. In simpler terms, one unit of a fungible token is indistinguishable from another unit of the same type. Also, the most well-known example of fungible tokens is cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Each unit of Bitcoin, for instance, is identical to any other unit of Bitcoin, making them fungible.

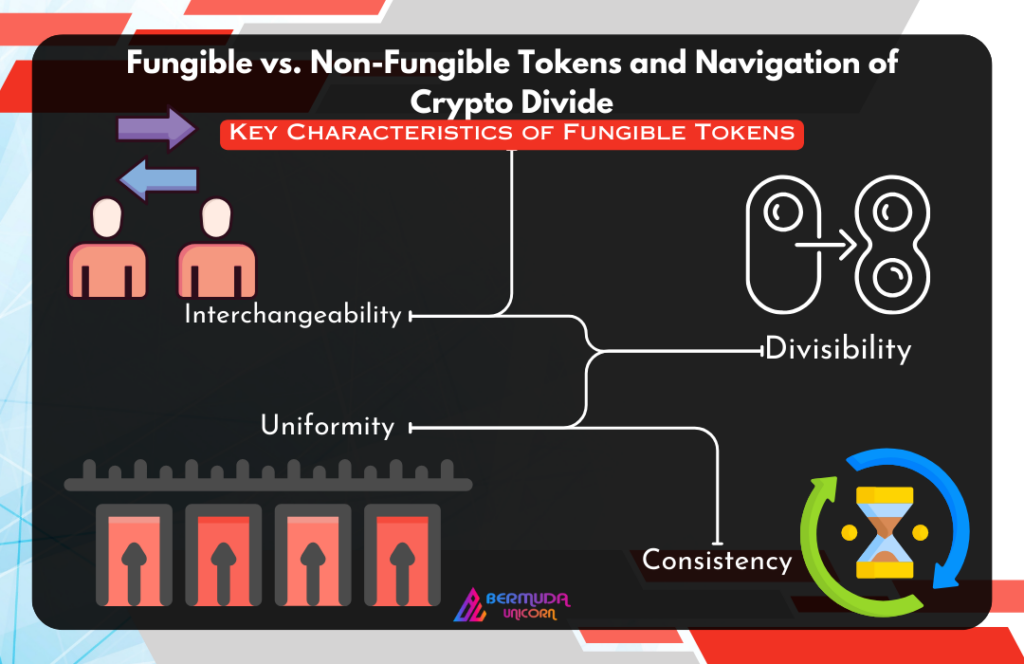

Key Characteristics of Fungible Tokens:

1. Interchangeability:

Fungible tokens can be exchanged for one another without any loss of value or distinction. Also, for instance, you can trade one Bitcoin for another, and they will have the same value.

2. Divisibility:

Fungible tokens are divisible into smaller units. For example, you can own a fraction of a Bitcoin, such as 0.1 BTC.

3. Uniformity:

Every unit of a fungible token has the same properties, and they can be used interchangeably in transactions.

4. Consistency:

Fungible tokens have consistent values and can be used as a medium of exchange, just like traditional fiat currencies.

Non-Fungible Tokens (NFTs): Unique and Immutable Assets

On the other hand, non-fungible tokens (NFTs) represent a completely different class of digital assets. Unlike fungible tokens, each NFT is unique and cannot be replaced or exchanged on a one-to-one basis. Also, NFTs are often used to represent ownership or proof of authenticity of digital or physical assets, such as art, music, collectibles, and virtual real estate.

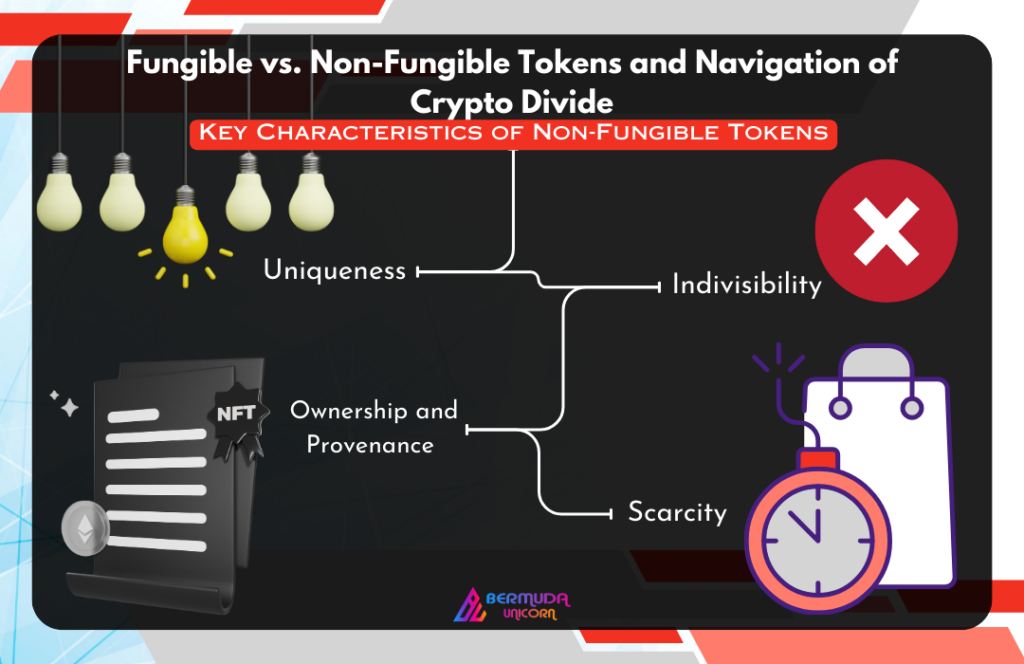

Key Characteristics of NFTs:

1. Uniqueness:

Each NFT has a distinct value and set of properties. Also, it makes it impossible to exchange one NFT directly for another.

2. Indivisibility:

NFTs cannot be divided into smaller units like fungible tokens. They exist as whole, unique entities.

3. Ownership and Provenance:

NFTs are often used to verify ownership and provenance of digital or physical assets, providing a transparent and immutable record of their history.

4. Scarcity:

The scarcity and uniqueness of NFTs often drive their value. Also, collectors and enthusiasts seek one-of-a-kind digital assets.

Applications and Significance

Fungible Tokens:

1. Digital Currencies:

Fungible tokens like Bitcoin and Ethereum are used as digital currencies. Also, facilitates peer-to-peer transactions and acts as a store of value.

2. Smart Contracts:

Fungible tokens are essential for the functioning of smart contracts, which automate and enforce contractual agreements on the blockchain.

3. Cryptocurrency Exchanges:

Fungible tokens are traded on cryptocurrency exchanges. Also, users can buy, sell, and trade them like traditional assets.

Non-Fungible Tokens (NFTs):

1. Digital Collectibles:

NFTs have revolutionized the concept of digital collectibles, allowing artists and creators to sell unique digital artworks, music, and other creations to collectors.

2. Gaming:

NFTs are used in gaming to represent in-game assets, characters, and land ownership in virtual worlds, providing players with true ownership.

3. Authentication and Provenance:

NFTs are used in the art world to verify the authenticity and ownership of physical and digital artworks, combating fraud and forgery.

4. Tokenization of Real-World Assets:

NFTs can represent ownership of physical assets like real estate, making it easier to buy and sell fractional ownership.

The Future of Crypto: A Harmonious Coexistence

Fungible and non-fungible tokens represent two sides of the cryptocurrency spectrum. Fungible tokens provide the foundational infrastructure for digital currencies and blockchain technology, while NFTs add a layer of uniqueness and value to the digital world.

In the future, we can expect to see more innovative use cases for both fungible and non-fungible tokens. As blockchain technology continues to evolve, these two types of tokens will likely coexist and complement each other in ways we can only begin to imagine.

Whether you’re a crypto enthusiast, artist, gamer, or investor, understanding the distinctions between fungible and non-fungible tokens is essential in navigating the vast and exciting world of crypto-currencies. As the crypto divide expands, these tokens will continue to shape the way we perceive and interact with digital assets, unlocking new possibilities and opportunities along the way.

Frequently Asked Questions (FAQs)

1. What is a fungible token?

– A fungible token is a digital asset that is interchangeable on a one-to-one basis with other tokens of the same type, like cryptocurrencies such as Bitcoin or Ethereum.

2. What is a non-fungible token (NFT)?

– An NFT is a unique digital asset that cannot be exchanged on a one-to-one basis with other tokens. Each NFT has distinct properties and represents ownership or authenticity of digital or physical items.

3. Can I divide fungible tokens into smaller units?

– Yes, fungible tokens can be divided into smaller units, allowing for fractional ownership. For example, you can own a fraction of a Bitcoin.

4. Can I divide non-fungible tokens (NFTs) into smaller units

– No, NFTs are indivisible, and they exist as whole, unique entities. You cannot divide them into smaller parts.

5. What are some use cases for fungible tokens?

– Fungible tokens are used as digital currencies, in smart contracts, and for trading on cryptocurrency exchanges.