![]()

Non-fungible tokens (NFTs) and cryptocurrency have become two of the most talked about topics in recent years, ( NFTs vs Cryptocurrency )with each providing unique opportunities for investors, businesses, NFTs & Crypto, and individuals. However, many are not aware of the key differences between the two or how they can be used to benefit their portfolios. NFTs and cryptocurrencies have taken the world by storm as investments, with many people trying to understand the differences between them. Both have unique benefits that can help investors make profitable decisions, but it is important to understand how they differ and which one is right for a given investment strategy. This article will provide an overview of what Non-Fungible Tokens (NFTs) and Cryptocurrency are, their key differences, and the advantages each offers investors.

What Are NFTs?

NFTs, or non-fungible tokens, are a type of cryptocurrency that exist on a blockchain and can be used as digital assets. Unlike other cryptocurrencies like Bitcoin and Ethereum, NFTs cannot be exchanged for one another because they are unique in value and have different attributes. This means that each NFT is tied to its own unique features, making them much more scarce than other types of digital currencies. Additionally, NFTs can also represent tangible items such as artwork or collectibles.

One of the main benefits of using an NFT is that it allows users to purchase physical items without having to go through the hassle of traditional transactions. The user simply needs to purchase the item with their NFT token and transfer it to the seller’s wallet. This eliminates any risk associated with sending money through traditional payment methods such as banks or credit cards. Additionally, since these tokens are stored on a blockchain, there is added security due to the immutability of these transactions – meaning nobody else can alter them once they have been made.

Lastly, unlike other forms of cryptocurrency which can fluctuate greatly in value over time, NFTs generally remain more stable due to their scarcity and overall use case – meaning they do not experience wild price swings like some other forms of crypto assets do. As more users continue to adopt this technology we may also see even more innovative uses for these tokens being developed in the future as well!

What is Cryptocurrency?

Cryptocurrency is a digital currency that uses cryptography for security and is stored in a digital ledger. It does not exist in physical form, making it easier to transfer funds and store value. Cryptocurrency transactions are secured by blockchain technology, which means the process is decentralized and immutable. This makes it impossible for any individual or group to manipulate the records of cryptocurrency transactions. Furthermore, cryptocurrency networks are open-source, meaning anyone can view the code used to create them and verify their security.

The most popular type of cryptocurrency today is Bitcoin, but there are many other varieties such as Ethereum and Litecoin. These currencies can be used to purchase goods and services online or traded on exchanges like stocks and bonds. They also offer investors an alternative way to hedge against inflation or protect their portfolios from market volatility since they do not rely on traditional financial institutions such as banks or governments.

Key Differences Between NFTs & Crypto

NFTs (Non-Fungible Tokens) are unique digital assets stored on a blockchain that cannot be replaced or exchanged. Unlike cryptocurrencies, which are interchangeable and can be used to purchase goods and services, NFTs represent something tangible or intangible and can’t be exchanged for anything else. NFTs have a wide range of applications, from artwork and collectibles to digital gaming items.

Another key difference between NFTs and cryptocurrency is their use cases. Cryptocurrency was designed primarily as an alternative form of currency for payments, while NFTs are more focused on creating programmable digital assets with ownership rights built into them. As such, NFTs provides users with the ability to create, trade, buy and sell unique digital content like artwork or gaming items in a secure manner. Furthermore, since each token is non-fungible it has an immutable record of ownership attached to it meaning that the true owner can always prove they own the asset if required.

Finally, another key advantage of using NFTs over traditional cryptocurrency is their flexibility when it comes to monetizing digital content like gaming items or artworks. By minting these assets onto the blockchain as unique tokens they become tradable commodities that you can monetize directly without having to go through intermediaries like traditional banking institutions or payment platforms such as PayPal.

NFT has Two Different modules according to generation which are NFT 1.0 and NFT 2.0 – click here

Benefits of NFTs vs cryptocurrency

One of the main benefits of NFTs over cryptocurrencies is that they are unique, or non-fungible. This means that, unlike the currency, each token has its own unique characteristics and cannot be exchanged for another token or “spent” in the same way. This makes them ideal for collectors, who can purchase a one-of-a-kind digital asset that cannot be duplicated by anyone else. Furthermore, since each NFT is owned by an individual and not a centralized entity like a bank, buyers have full control over their purchases with no risk of it being taken away from them.

Another benefit of NFTs compared to cryptocurrencies is that they are much quicker and easier to use when making transactions. While cryptocurrency transactions can take several minutes up to hours to process due to block sizes and miner confirmations needed before completion; many platforms allow NFT sales and purchases within seconds as there is no need for network confirmation in order for the transfer to go through successfully. Lastly, some platforms also offer additional features such as smart contracts which further enable users to securely store information associated with their assets on the blockchain providing greater transparency than what would be possible with other digital assets.

Advantages & Disadvantages of Each

One of the primary advantages of NFTs is that they are truly non-fungible and therefore, provide a unique digital asset ownership experience. By creating a digital asset with distinct properties, buyers are able to own something that cannot be replicated. This makes it difficult for counterfeiting or double spending to occur. Furthermore, as NFTs become more popular, their value can increase as investors come into the market aiming to capitalize on potential gains.

On the contrary, cryptocurrency offers more flexibility compared to NFTs when it comes to trading and transacting with digital assets. Since cryptocurrencies are built upon an open source platform such as Ethereum and Bitcoin blockchain networks, users have access to more advanced features like smart contracts and decentralized applications (dApps). This allows users to quickly exchange tokens without needing third-party intermediaries like banks or payment processors. Additionally, due to their decentralized nature, cryptocurrencies offer greater privacy than other financial instruments such as credit cards and bank accounts which may require personal information for transactions.

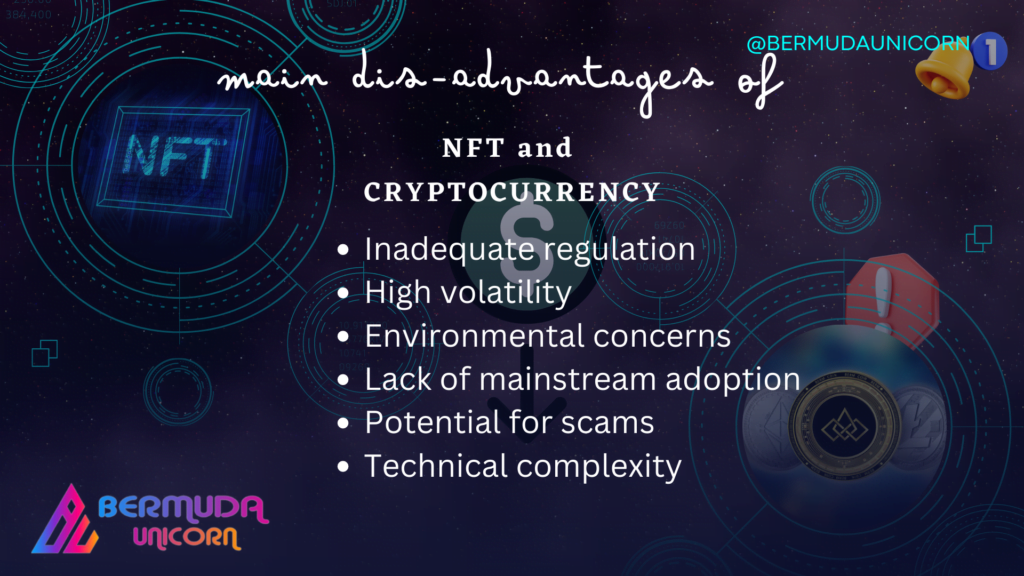

Lastly, both NFTs and cryptocurrency have some drawbacks that should be considered before investing in either one of them. For example, while there is no central authority governing cryptocurrency transactions as well as no physical form associated with these digital assets; this also means that there is less legal recourse available if anything were ever to go wrong during a trade or purchase of either one of these technologies.

NFTs vs cryptocurrency: Which is Better?

When it comes to deciding which type of asset is better, NFTs or cryptocurrency, it ultimately depends on the user’s individual needs and preferences. For investors looking for short-term profits, cryptocurrencies may be a better option since they can be traded quickly and easily in the markets. On the other hand, those who are interested in more long-term investments may find NFTs to be more beneficial due to the unique characteristics that allow them to appreciate in value over time. Additionally, NFTs also appeal to collectors who are looking for unique digital assets that cannot be replicated or devalued like traditional currencies can.

It is important to note that both asset classes have their own advantages and disadvantages which should be taken into consideration when making an investment decision. Cryptocurrencies provide fast liquidity and low transaction costs but come with high volatility and security risks; NFTs offer unique ownership rights but require longer verification times and incur relatively higher fees. Ultimately, both asset classes offer different benefits depending on what kind of use case you are looking for; investors should consider their personal needs when determining which one is best suited for them.