Polygon (MATIC) is an Ethereum-based blockchain network that focuses on improving scalability and reducing gas fees for users. It is a Layer-2 scaling solution that aims to provide faster and cheaper transactions while maintaining the security and decentralization of the Ethereum network. In this beginner’s guide, we will explore what Polygon Matic is, how it works, and the benefits of investing in it.

What is Polygon Matic?

Polygon Matic was launched in 2017 as Matic Network. In 2021, the project was rebranded to Polygon, which reflects its broader vision of becoming a multi-chain ecosystem. Polygon is an Ethereum-compatible blockchain that is built on top of the Ethereum network as a Layer-2 scaling solution. It aims to provide fast and cheap transactions while maintaining the security and decentralization of the Ethereum network.

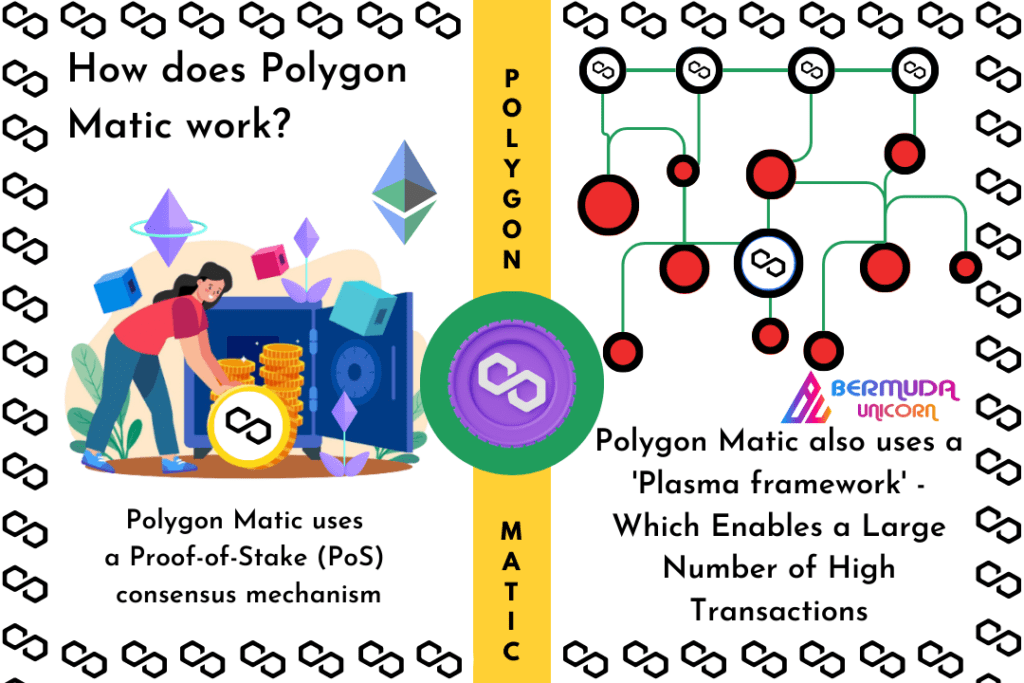

How does Polygon Matic work?

Polygon Matic uses a Proof-of-Stake (PoS) consensus mechanism, which is more energy-efficient than the Proof-of-Work (PoW) mechanism used by Ethereum. PoS allows users to participate in the network by staking their tokens, which helps secure the network and enables them to earn rewards in return. Polygon Matic also uses a Plasma framework, which enables it to process a large number of transactions off-chain while still maintaining the security of the Ethereum network.

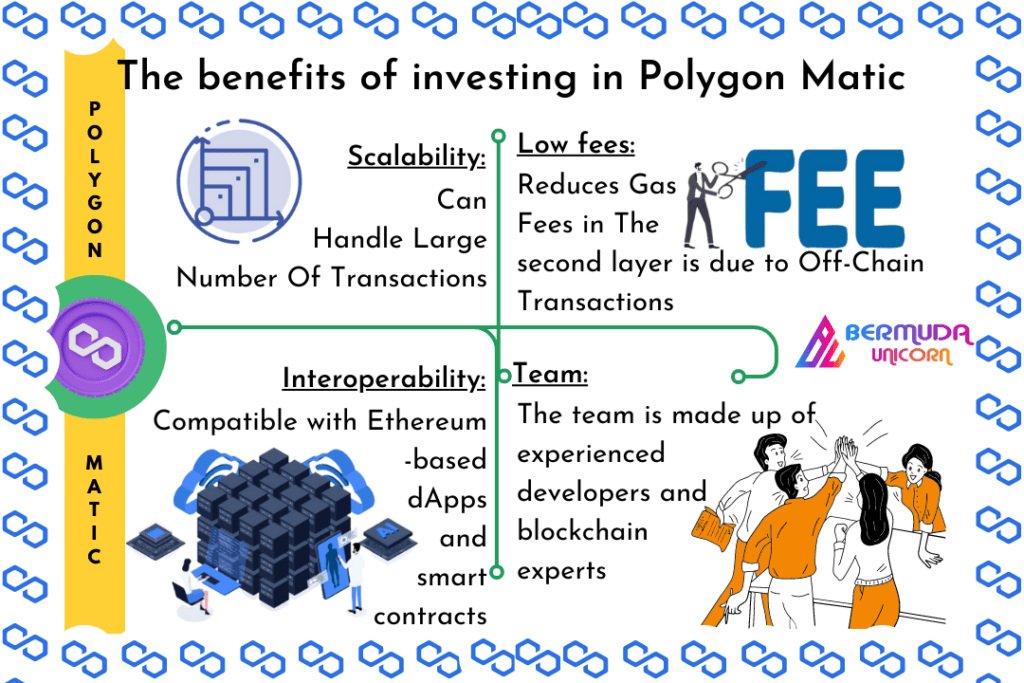

The benefits of investing in Polygon Matic

Scalability: One of the main benefits of investing in Polygon Matic is its scalability. The network is designed to handle a large number of transactions per second, which makes it ideal for decentralized applications (dApps) that require fast and cheap transactions. This scalability is achieved through the use of Layer-2 scaling solutions like Plasma and PoS.

Low fees: Another advantage of Polygon Matic is its low fees. The network’s Layer-2 scaling solutions enable it to process transactions off-chain, which reduces gas fees for users. This makes Polygon Matic a more affordable option for users compared to other blockchain networks like Ethereum.

Interoperability: Polygon Matic is built on top of the Ethereum network, which means that it is compatible with Ethereum-based dApps and smart contracts. This interoperability makes it easy for developers to port their Ethereum-based dApps to the Polygon network, which can help increase the adoption of the network.

Ecosystem: Polygon Matic has a growing ecosystem of dApps and projects that are being built on top of the network. This ecosystem includes projects in various sectors like finance, gaming, and NFTs. Investing in Polygon Matic can give you exposure to this growing ecosystem, which can potentially lead to higher returns on your investment.

Team: The Polygon Matic team is made up of experienced developers and blockchain experts who have a track record of building successful projects. The team’s expertise and experience give investors confidence in the network’s ability to deliver on its promises.

How to invest in Polygon Matic

There are several ways to invest in Polygon Matic. The most common way is to buy the MATIC token on a cryptocurrency exchange. MATIC is the native token of the Polygon network, and it is used for staking, transaction fees, and governance. Before investing in MATIC, you should do your research on the network and its potential for growth. You should also consider the risks involved in investing in cryptocurrencies, such as market volatility and regulatory risks.

Here are the steps to follow to invest in Polygon-Matic :

Set up a cryptocurrency wallet: Before you can buy MATIC, you will need a cryptocurrency wallet. A cryptocurrency wallet is a software program that stores your digital assets. There are several types of cryptocurrency wallets, including desktop, mobile, hardware, and web wallets. Choose a wallet that supports MATIC and other Ethereum-based tokens

Choose a cryptocurrency exchange: Once you have set up your wallet, you will need to choose a cryptocurrency exchange where you can buy MATIC. Some popular exchanges that list MATIC include Binance, Coinbase, and Kraken. Compare the fees and features of each exchange before choosing one that suits your needs.

Buy MATIC: After selecting your exchange, you can buy MATIC using your preferred payment method, such as a credit card or bank transfer. Once you have bought MATIC, you can transfer it to your cryptocurrency wallet for safekeeping.

Stake your MATIC: If you want to earn rewards by staking your MATIC, you can do so by using a supported wallet or a staking service. By staking your MATIC, you can earn rewards in the form of additional tokens.

Monitor your investment: It is important to monitor the performance of your investment regularly. Keep an eye on the price of MATIC and the overall performance of the Polygon network. This will help you make informed decisions about buying or selling your tokens.

Risks of investing in it :

Investing in cryptocurrencies like MATIC comes with certain risks that you should be aware of. These risks include:

Market volatility: The cryptocurrency market is highly volatile, and the price of MATIC can fluctuate rapidly. This means that you could potentially lose a significant amount of money if the market moves against you.

Regulatory risks: Cryptocurrencies are subject to regulatory risks, which can vary from country to country. Governments can introduce new regulations that could affect the adoption and use of cryptocurrencies.

Technical risks: The Polygon network is still in its early stages, and there is a risk that technical issues could arise that could affect its performance. These issues could potentially lead to a loss of value for MATIC and other tokens on the network.

Conclusion

Investing in Polygon Matic can be a potentially lucrative opportunity for investors who are looking to gain exposure to a growing ecosystem of dApps and projects. The network’s focus on scalability, low fees, and interoperability make it an attractive option for developers and users alike. However, investing in cryptocurrencies like MATIC comes with certain risks that should be carefully considered before making any investment decisions. It is important to do your research and to invest only what you can afford to lose.