The world of finance is constantly evolving and today, investors have more options than ever before. One of the most exciting innovations in finance in recent years is the rise of tokenized assets. This new way of owning and investing in assets is changing the game, allowing for new types of investments and democratizing access to assets that were once only available to the wealthy.

In this article, we’ll explore what tokenized assets are, why they are becoming increasingly popular, the types of assets that can be tokenized, how to invest in them, and the potential risks involved.

What are Tokenized Assets?

Tokenized assets are traditional assets that have been converted into digital tokens on a blockchain. This allows for fractional ownership of the asset, meaning that investors can own a portion of the asset rather than needing to purchase the entire asset outright. This type of ownership is made possible by the unique properties of blockchain technology, including its transparency, security, and ability to record transactions in a decentralized ledger.

Why Invest in Tokenized Assets?

There are several benefits to investing in tokenized assets. First and foremost, tokenization allows for fractional ownership, which means that investors can own a portion of an asset that they may not have been able to afford otherwise. This makes investing in traditionally high-value assets such as real estate, fine art, and collectibles more accessible to a wider range of investors.

In addition, tokenized assets can be traded on decentralized exchanges, providing investors with greater liquidity and flexibility. This allows investors to buy and sell assets more easily and quickly, without the need for intermediaries such as brokers or banks.

Finally, tokenization can also improve transparency and reduce costs associated with traditional asset ownership. By recording ownership and transaction information on a blockchain, tokenization can reduce the need for middlemen, such as lawyers and accountants, and minimize the potential for fraud and errors.

Types of Tokenized Assets

Almost any asset can be tokenized, but some of the most common types of tokenized assets include real estate, fine art, collectibles, and commodities. These assets are often high-value and illiquid, making them difficult for the average investor to access. However, by tokenizing these assets, investors can own a portion of them and potentially benefit from their appreciation in value.

Real estate is one of the most popular types of tokenized assets. Tokenization allows investors to own a fractional share of a property, providing access to the potential for appreciation in value and rental income. Fine art and collectibles, such as rare stamps or baseball cards, can also be tokenized, providing investors with a way to invest in assets that have traditionally been the domain of the wealthy.

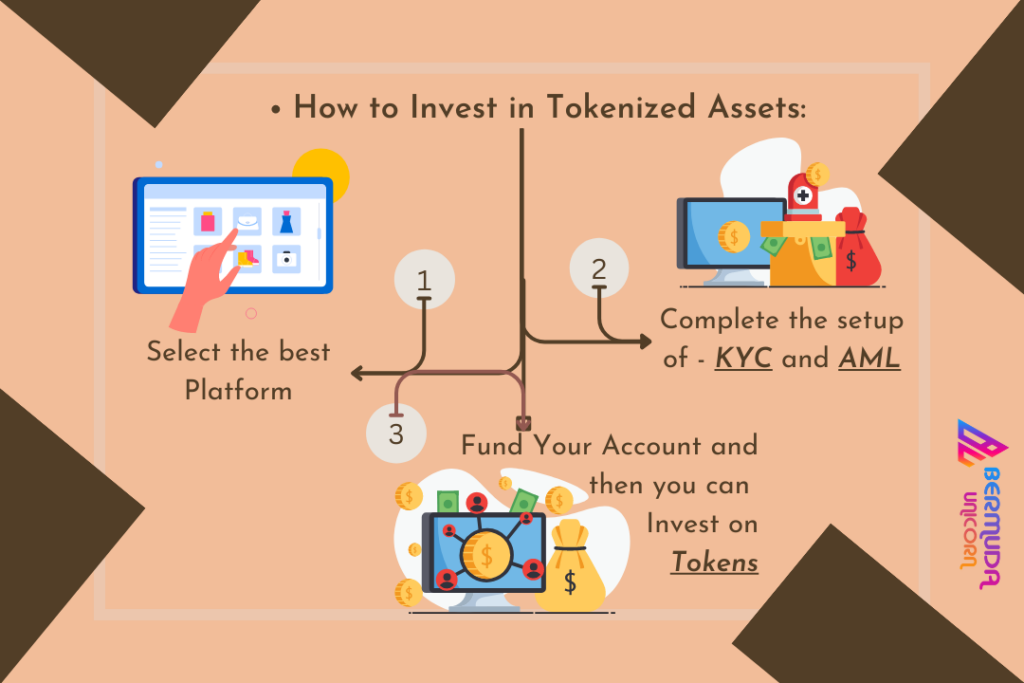

How to Invest in Tokenized Assets

Investing in tokenized assets is similar to investing in traditional assets, but there are some key differences to be aware of. The first step is to find a reputable platform that offers tokenized assets. Some popular platforms include Polymath, Harbor, and Swarm. It’s important to do your research and ensure that the platform is trustworthy, transparent, and compliant with regulations.

Once you have selected a platform, you will need to create an account and complete the necessary KYC (know your customer) and AML (anti-money laundering) checks. This is a standard procedure to ensure that the platform is not being used for illegal activities such as money laundering.

Next, you will need to fund your account with cryptocurrency or fiat currency, depending on the platform. Once your account is funded, you can browse the platform’s offerings and select the tokenized asset that you want to invest in. The platform will provide information about the asset, including its price, ownership structure, and potential returns.

When you invest in a tokenized asset, you will receive a digital token that represents your ownership of the asset. This token can be traded on decentralized exchanges or held as a long-term investment.

Risks of Investing in Tokens

While there are many benefits to investing in tokenized assets, there are also potential risks to be aware of. One of the main risks is that the market for tokenized assets is still relatively new and untested. This means that there is a higher level of uncertainty and volatility compared to more established markets such as stocks or real estate.

In addition, there is a risk of fraud or scams. Some platforms may not be reputable or may offer fraudulent investments, so it’s important to do your due diligence and only invest through trusted and regulated platforms.

Finally, tokenized assets are subject to the same market risks as traditional assets, including fluctuations in supply and demand, economic downturns, and geopolitical events.

Final Thoughts

Tokenized assets are an exciting new frontier in the world of finance, providing investors with a way to own and invest in assets that were once only available to the wealthy. By leveraging the unique properties of blockchain technology, tokenization allows for fractional ownership, greater liquidity, and improved transparency.

If you’re interested in investing in tokenized assets, it’s important to do your research and understand the potential risks and rewards. Look for reputable and regulated platforms, diversify your portfolio, and be prepared for the potential for volatility in this emerging market.

In conclusion, tokenized assets are a fascinating new development in the world of investing, offering a way to democratize access to assets and potentially earn returns on high-value assets that were once out of reach. With the right approach and due diligence, investors can participate in this exciting new market and potentially reap the rewards of ownership in the future.